Are We Facing a Tidal Wave of Inflation?

Context: The economy is the ship. Inflation is the tidal wave. This is Happening.

Remember that scene in the movie ‘The Poseidon Adventure’, when the Captain realizes the tidal wave is coming broadside and orders the ship to turn, but it’s too late!

Well, that’s kinda how I feel right now.

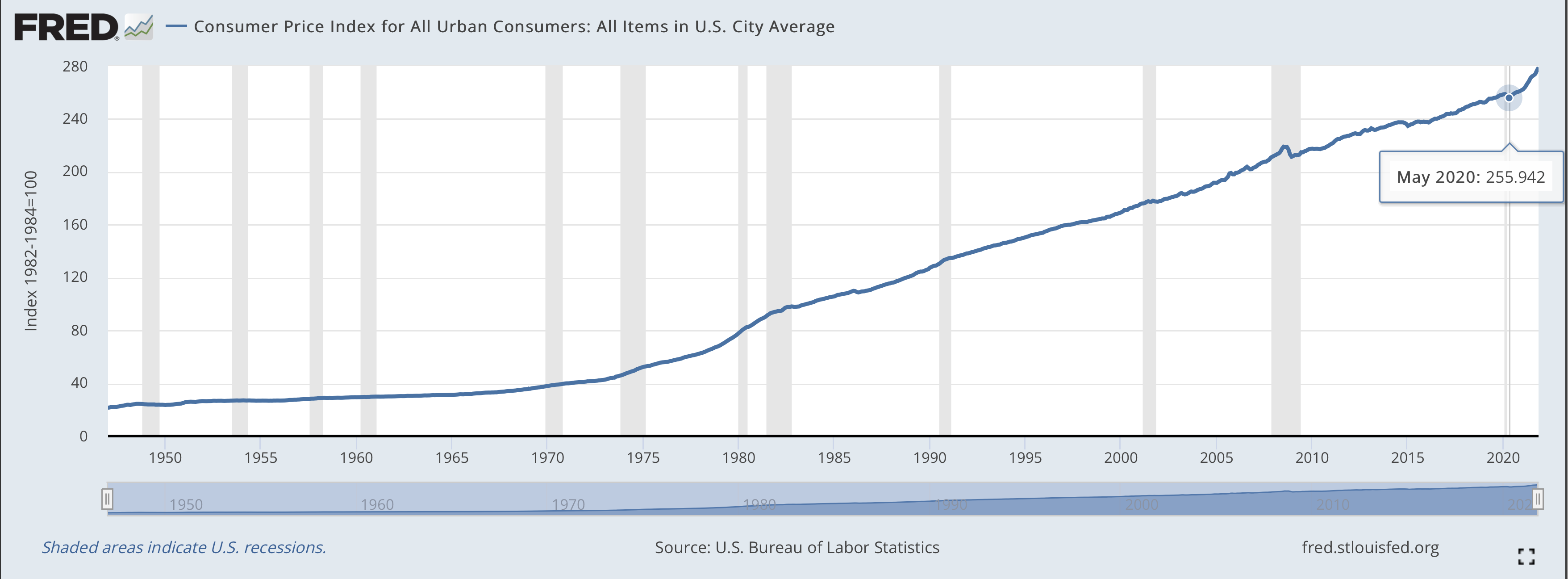

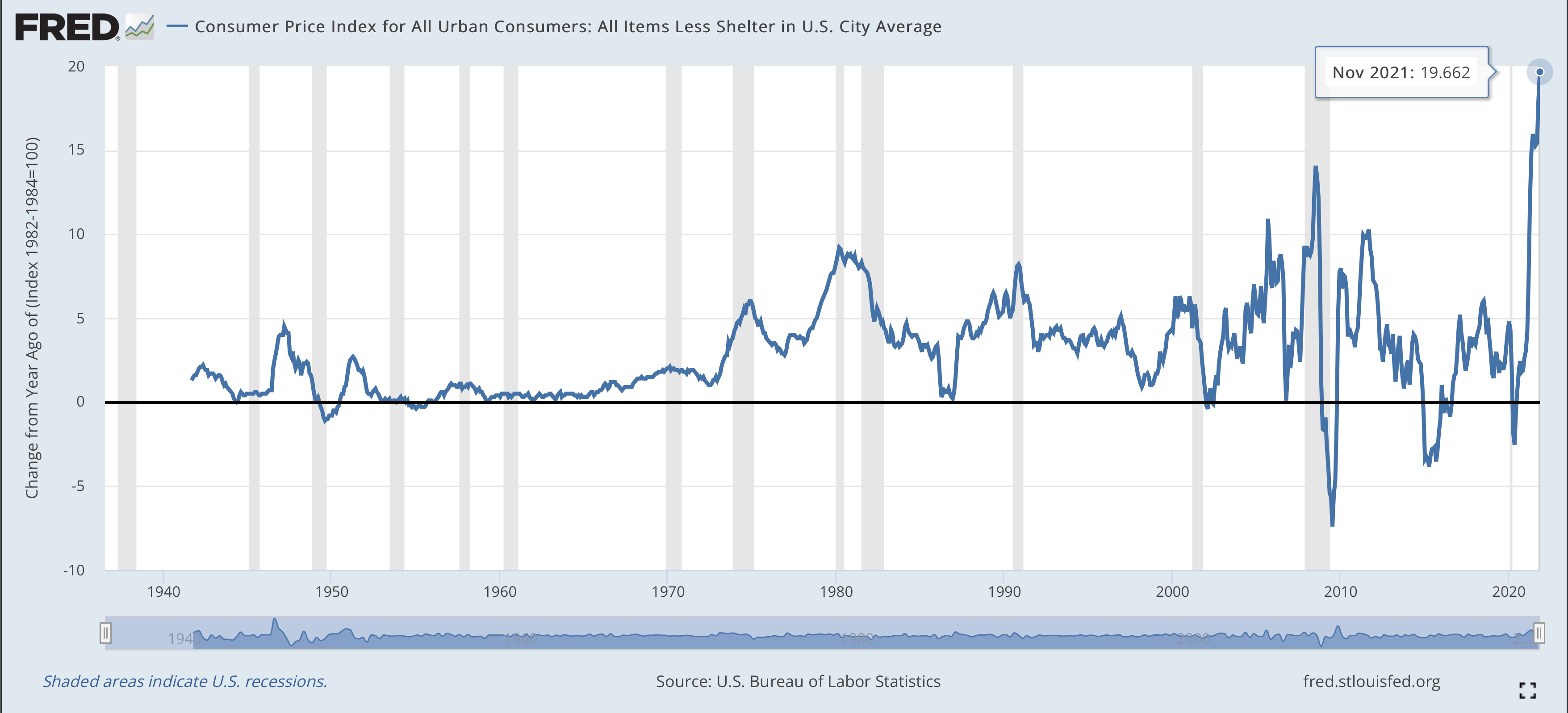

On Dec 28, 2021, I decided to take a look at the radar screen for inflation. It’s called the CPI (Consumer Price Index).

So I went to the St. Louis Fed’s web site to look at CPI in the FRED database. They’ve got some great tools there.

It kinda looked normal at first. But then I noticed a blip on the radar. Right after Trump dropped the interest rates to zero and they started Max QE (Quantitative Easing). It’s a sharper wave to the upside on the upper right in the chart.

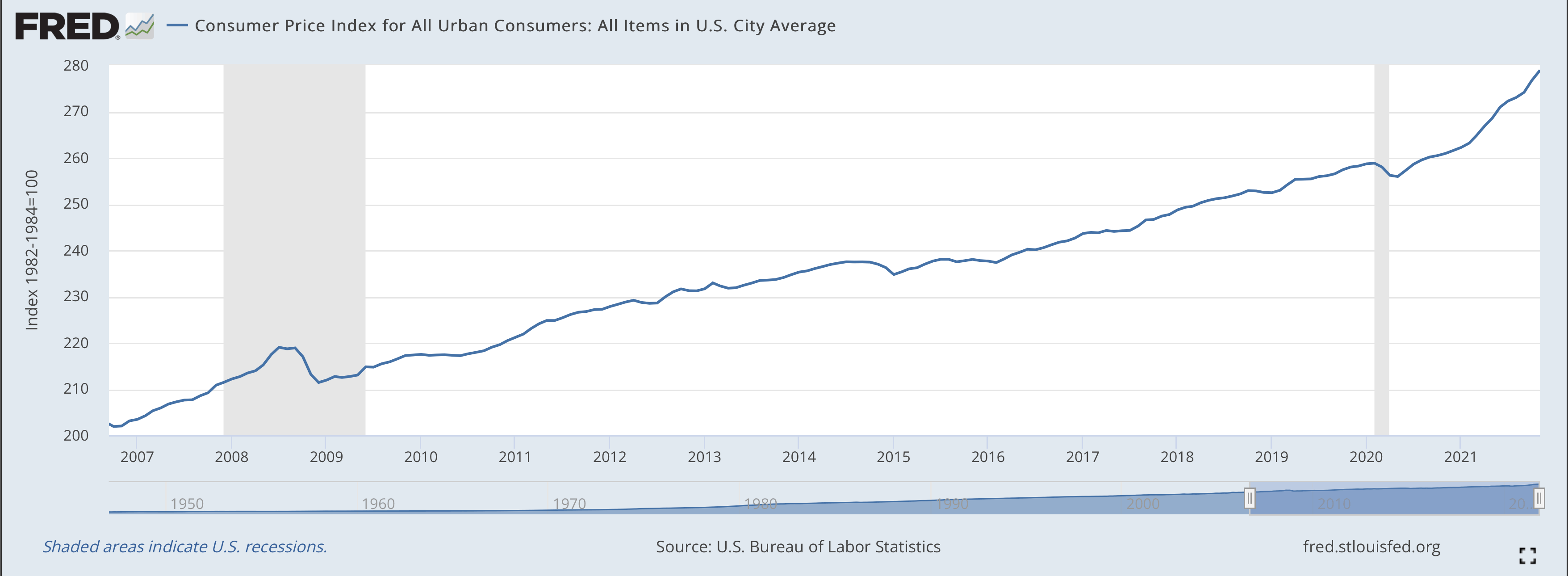

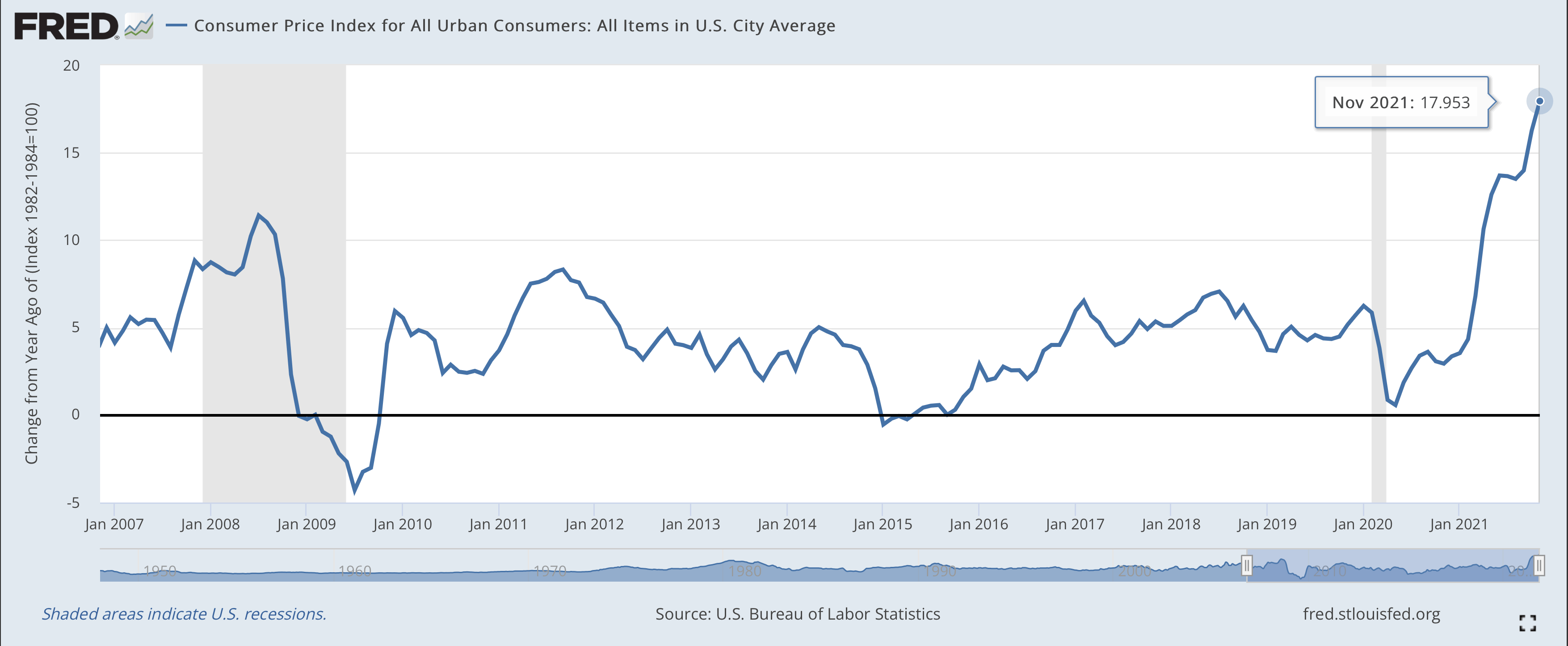

This is the blip on the radar that gets you curious enough to look further. From a wide view it did not look like much, so I decided to zoom in a bit. Now it looked more prominent. I could see a strong wave rising up from May, 2020. It was more pronounced than the 2008 rise during the real estate bubble.

It was visible. It looked like inflation was faster than the 2008 inflation bump. But by how much?

So I clicked on the edit graph button to see if I could get a relative ratio analysis of the wave that was coming at us. I left the Units on top set to Index 1982-1984 = 100. Then in the custom section I clicked on ‘Change from a Year ago’. I wasn’t looking for a percentage ratio, I just wanted to see the relative acceleration of the inflation curve. As soon as I entered the data, it hit me. Relatively speaking, it looked like a tidal wave of inflation.

Does Speed Equal Inertia & Momentum?

Looking at the speed of the change and considering the amount of liquidity that was injected into the global economy over the past year and a half, one might want to consider how much inertia that adds to the inflation wave we are sailing into.

Then I had this feeling that there was a tidal wave coming at us and it’s not a small one. What it showed me was that we have to turn the ship, fast. If the wave comes from port-side, you would reverse the port engines and set starboard engine to full while turning the rudder hard to port. That means we need to stop the bond buying more quickly and get started on raising the interest rates sooner as well.

Looks Like the Federal Reserve is Behind the Curve, Again.

It dawned on me, the Federal Reserve was not just a little behind the curve. Relatively speaking, it looks like they are strongly behind the curve. That indicates potential for a sharper inflation spike. This is clearly the sharpest CPI inflation spike in the FRED database.

The Epicenter of this Economic Earthquake

As of now it certainly looks like the global economy is steaming along and doing fine just like the SS Poseidon before the tidal wave struck.

You see, the CPI (consumer Price Index) is like a radar detection system for waves of inflation. And just like the SS Poseidon, we are sailing along, everyone’s enjoying cocktails, and record highs in the stock market.

The magnitude of this economic earthquake comes strongly from the actions taken by the Trump Administration in 2020. But we should not ignore policy changes that reach back to the 70’s and of course the infamous decisions during the 90’s that allowed the stock market to create CDO’s (Collateralized Debt Obligations) that were largely opaque and SEC (Security Exchange Commission) regulation changes that disabled safety mechanisms for our economy.

But first, let’s unpack this all a bit:

Recently we’ve heard from Fed Chair Powell and Treasurey Secretary Yellen that the inflation bump is largely pandemic related. Well, yes and no.

Trump did use the pandemic to shove/force Fed Chair Powell to drop the rate to zero even throwing out (not so) veiled threats (in 2019) that if he did not, Trump would just fire him.

Janet Yellen is famous for being data driven and that’s a good thing. But is she looking are all the ‘relevant data’? If she is looking at the outputs she can see the CPI rise. I wonder if she and Fed Chair Powell calculated the massive influx of liquidity combined with the debt loading into the inflation potential equation?

The reason I say that is because it seems obvious to me that if you inject a flood of money and tell Central Bank zero interest rates are the solution. Well, then the wheels are greased, and its full steam ahead.

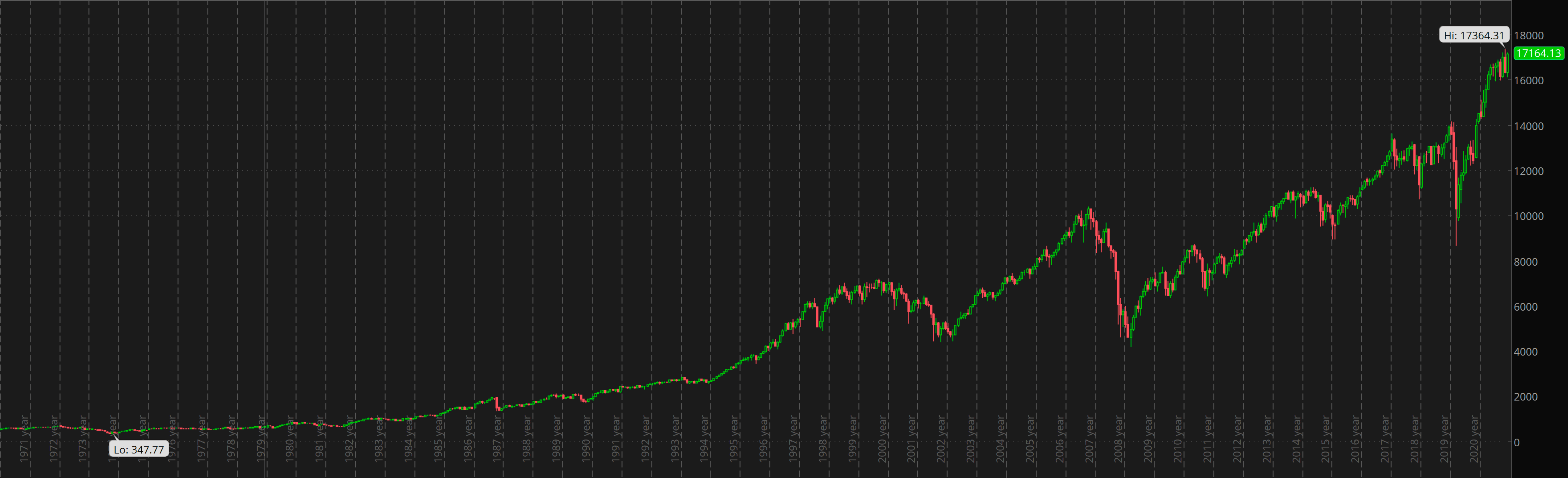

So what we saw was the market rise in the middle of massive debt loading, massive monetary injections, in the middle of a global pandemic, and a true devil-may-care attitude.

This caused the market to float up on low taxes for corporations, combined with the liquidity injections, and the low fed rate. When the pandemic hit, the market was already unrealistically high on Trumps ‘let’s not be responsible’ plan, which included Trumps ‘let’s raise the national debt’ plan (even though he said he would lower the national debt).

If we examine the major market events since the Internet Bubble, we can easily see the impacts of various policies expressed in the NYSE (New York Stock Exchange) chart going back to 1970.

Trump vs Shiller – Let’s Get Ready To Rumbleeee…

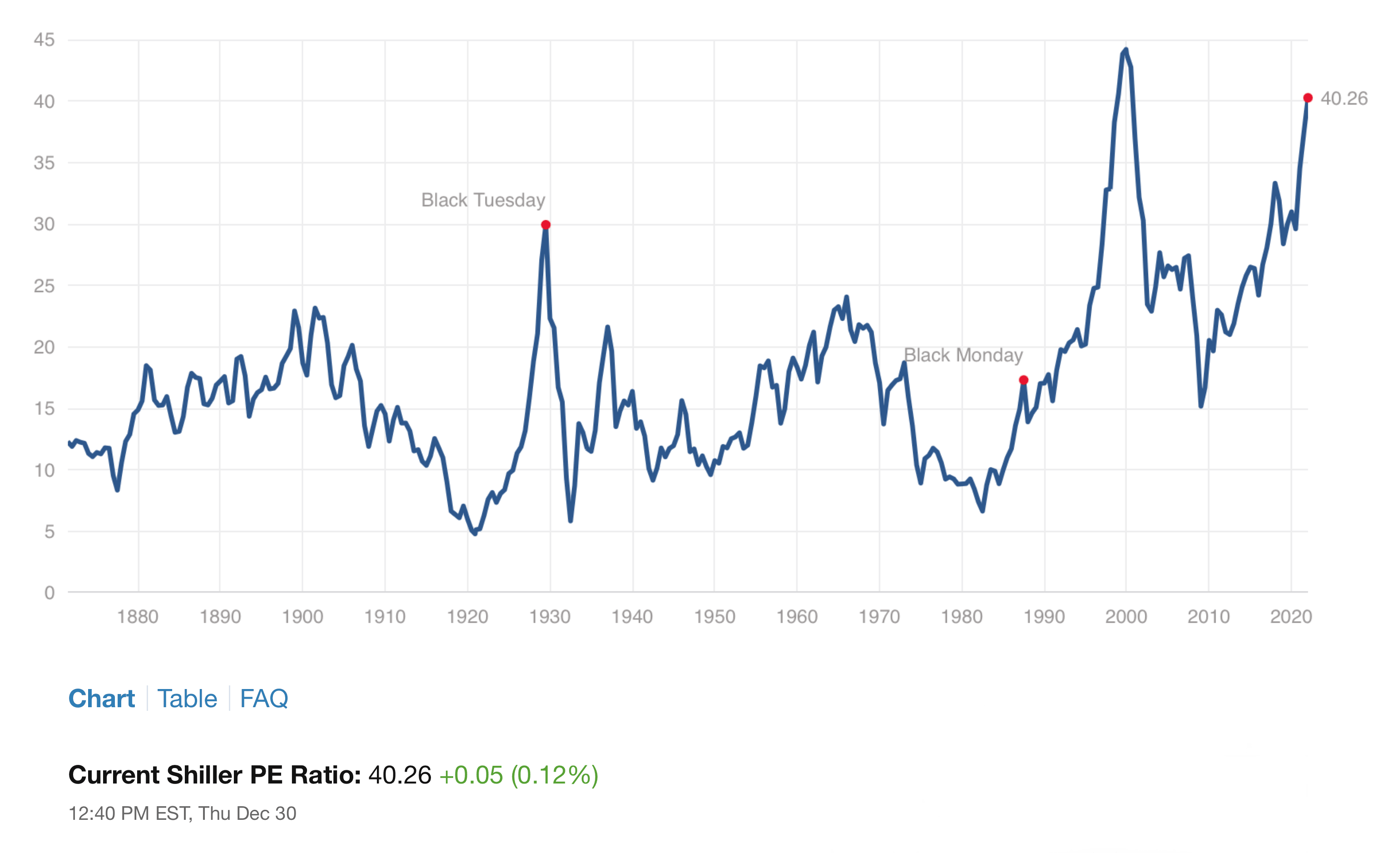

On March 22nd of 2020 I did a piece highlighting the Shiller P/E ratio when it was around 25. Mind you, it had already hit 30 which is pretty high and then pulled back. The Shiller is a great gauge because it accounts for inflation in its calculation to assess risk values.

At that time Trump had been pushing the Fed to lower interest rates to zero (even before the Pandemic). When the pandemic hit the world, Trump pushed even harder for the Fed to go to zero, AND go into Max QE (Maximum Quantitative Easing).

I’ve said this before but it bears repeating with greater specificity: Had Trump treated the pandemic seriously instead of saying it’ll just go away in a few weeks and it’s just like the flu; had Trump encouraged wearing face masks and social distancing; had Trump encouraged his followers to be careful and mindful of putting others at risk; the spread would not have been as bad.

FACT CHECK: Donald Trump on Feb 7, 2020, private interview with Bob Woodward: “You just breathe the air, and that’s how it’s passed,” and “more deadly than even your strenuous flu,” and “You know? So, this is deadly stuff.”

Trumps 2020 statements mostly downplaying the virus even though Donald knew on Feb 7, 2020:

Feb 7: [Privately] “You just breathe the air, and that’s how it’s passed…,” and

Feb 7: [Privately] “…more deadly than even your strenuous flu…,” and

Feb 7: “You know? So, this is deadly stuff.”

Feb 7: “…becomes weaker with warmer weather, and then gone.”

Feb 10: “A lot of people think that goes away in April”

Feb 19: “I think it’s going to work out fine…,”

Feb 23: “We have it very much under control in this country…,”

Feb 24: “The Coronavirus is very much under control in the USA…,”

Feb 25: “We have very few people with it… They’re all getting better…,”

Feb 26: “This is a flu. This is like a flu…,”

Feb 26: “…within a couple of days is going to be down to close to zero…,”

Feb 27: “It’s going to disappear. One day — it’s like a miracle — it will disappear.”

Feb 29: “We’ve taken the most aggressive actions to confront the coronavirus.” NOT TRUE China did.

Mar 9: “…546 confirmed cases of CoronaVirus, with 22 deaths. Think about that!”

Mar 10: “…we’re doing a great job with it. And it will go away.”

Mar 12: “Other countries that are smaller countries have many, many deaths.”

Mar 24: “We lose thousands and thousands of people a year to the flu.”

MARCH 15: Federal Reserve cuts lending rate effectively to zero and adds a Max QE program.

Mar 31: “A lot of people have said, … just ride it out and think of it as the flu.’ But it’s not the flu. It’s vicious…,”

By ignoring the serious nature of the virus, Trump made America the poster child for what not to do in a global pandemic. Don’t lie to the public is the first rule. By downplaying the virus and joking about masks being anti-freedom, Trump created vaccine resistance and hesitancy that now plagues Americans.

Currently

We have a large portion of the public still resistant to vaccines that can help end the pandemic. I’ll go this far: if I were president at the beginning of the pandemic, I would have pushed harder to prevent the spread of the virus, and worked harder on safe ways to keep the economy moving. Trump also abused his power by not protecting America from abuse in an emergency. He did not use the Defense Production Act (DPA) to help States manage the pandemic. In fact available evidence indicates he used the DPA to manipulate his opponents and reward his friends.

Simply being responsible with how we interact would have helped tremendously. And yes, I would have followed CDC guidelines and not threatened healthcare professionals by having them accompanied with armed guards to dissuade them from telling the truth about the virus.

If Trump were smarter he would have told the truth, kept the public viral load lower, and lessened the economic impacts. Effectively that would also have meant we would not have imposed such large debts on the American public.

REMEMBER THIS: It’s not Trumps money he blew, it’s a debt owed by American taxpayers, which arguably he is not one of. In fact Trump, as sole owner of his company has been convicted multiple times for tax evasion and fraud.

The Fed should not have dropped the rate all the way to zero, but they might have needed to drop it a point or so. And the bond buying program may not have been needed either, or needed less.

The result of Trumps actions made the markets go up (read as inflate). To put it simply free money makes for fake markets and the Shiller P/E, also known as the CAPE ratio, started to rise. The extreme liquidity injection actually caused the markets to float on a sea of excess liquidity.

In 2021, the Shiller went above 40 at market peaks. The last five trading days of the year saw the Shiller above 40 for four days. On the last trading day, Dec. 31, it closed at 39.38. The December 30 session shown below again closed above 40.

The QE bond buys from the Fed, and the zero interest rates, are the power behind this rising wave of inflation. Trump wanted to give a booster shot to the economy so he would look good for the election. And yet he still was not promoting vaccines to boost American citizens ability to fight Covid.

Had I been in Biden’s seat when he took office last January, I would have made the argument we need to address this issue, right away. It is obvious the excess liquidity would result in higher inflation. The fact the Fed did not want to move until it started to show up ‘ more significantly’, in the CPI, simply meant the Fed would again be behind the curve. The math is the tell. Too much money = inflationary pressure. In my view, that means why wait to begin preventive measures.

Biden has a lot on his plate right now with Russia pushing for a Ukrainian invasion; China pushing for a Taiwan takeover and a global pandemic that is still dealing with the fact that large amounts of people continue to volunteer to be human petri dishes for Covid mutation…. So the economy, was left to the wisdom of the Federal Reserve and Trump’s appointee, Jerome Powell. With all the varied concerns, including GOP disinformation and American Republican Democracy on the line, it’s no wonder these are harder decisions than normal.

But now the seeds of inflation are taking root in the economy. While many still think the economy is fine, at least some experts are ringing the alarm bell.

Source Links

- The St. Louis Fed FRED Data for CPI

- Shiller PE CAPE Ratio Track

- ‘Big Short’ investor Michael Burry warns stock-market reminds him of dot-com bubble

- All The Times Trump Compared Covid-19 To The Flu

- Trump Admin Policy Failures Compounded Coronavirus-Induced Economic Crisis

- Trump Resists Using Wartime Law To Get, Distribute Coronavirus Supplies

- The federal government’s coronavirus response—Public health timeline

- Administration’s mixed messaging on Defense Production Act causes confusion

- ‘It’s a two-way street’: Trump suggests federal aid will be for governors who ‘treat us well’

- Economists sound first warning bells on inflation

- Germany’s incoming finance minister rings alarm bell on inflation

- Warren Buffett says Berkshire Hathaway is seeing ‘very substantial inflation’ and raising prices

- Jun 26, 2019: Trump says he can fire Fed’s Powell; it’s not that simple

- Aug 27, 2019: Why is Trump attacking the Federal Reserve?

- Oct. 31, 2019: Trump rails against Powell a day after the Fed cuts rates

Unite America with The Centrist Party

- The Centrist News invites you to consider joining the Centrist Party. We all need to work together to heal our nation and return balance in governance and common sense for our nation and the people.