Market Report: Dec. 2, 2021

Graphic Lines Key: Beige = 30 day; Yellow = 50 day; Red = 200 day

Massive liquidity was injected into the global economy due to the pandemic.

The Trump tax cuts in America reduced America’s capacity to respond to additional emergencies. Like it or not, Trump did it to make himself look better while risking not only America’s economy, but the entire world. That’s what megalomaniacs do.

Liberal means to freely give away. The Trump administration decided on a very liberal policy in multiple areas. Trump was liberal with the truth meaning he gave it away and decided lying to and misrepresenting reality was the better way to go. Then he pushed for 0% interest rates and kicking in a QE wave of bond buying by the Fed. He pushed hard, and quite frankly whined like a baby, and threatened his people if they did not do what he wanted. He didn’t get everything he asked for but he got most of it. So here we are.

It’s a funny thing, I hear:

‘this time it’s different’ and ‘we’re in a different market’. But a market is a market. Supply and demand, debt and risk.

At the beginning of a bear move, typically the first to fall is the Russel. At least that is what you tend to hear in trading classes. The first US index to get below the 200d moving average was the Russel on Nov. 26, 2021. The Dow dipped below on Dec. 1, 2021. The S&P dipped below the 200d on Dec. 1 also. And the Q’s are now approaching the 200d and below the 50d.

Overall, monetary and fiscal policy has been too liberal for decades, at least since the 80’s as we began to see the impact of buying politicians post Buckley vs. Valeo (1976).

Here is our current status:

Fed Chair Powell now states Fed may have to pull back QE earlier than expected and address low interest rates.

Note: It is in fact the QE and low interest rates that have put us in the position we are now in. For those that would argue we had to lower interest rates due to the pandemic. I agree, but not that low. And, if Trump had not been so selfish as to only think about himself, America s response to the pandemic would have been smarter and we would not have needed as much economic stimulus. Instead, Trump made America the Covid capital of the world. Those are the facts.

Result of Trumps actions and lack of action on pandemic:

- Greatly reduced response capability for additional emergencies.

- Largely reduced response capability to future costs due to global warming.

Current Economic Risk:

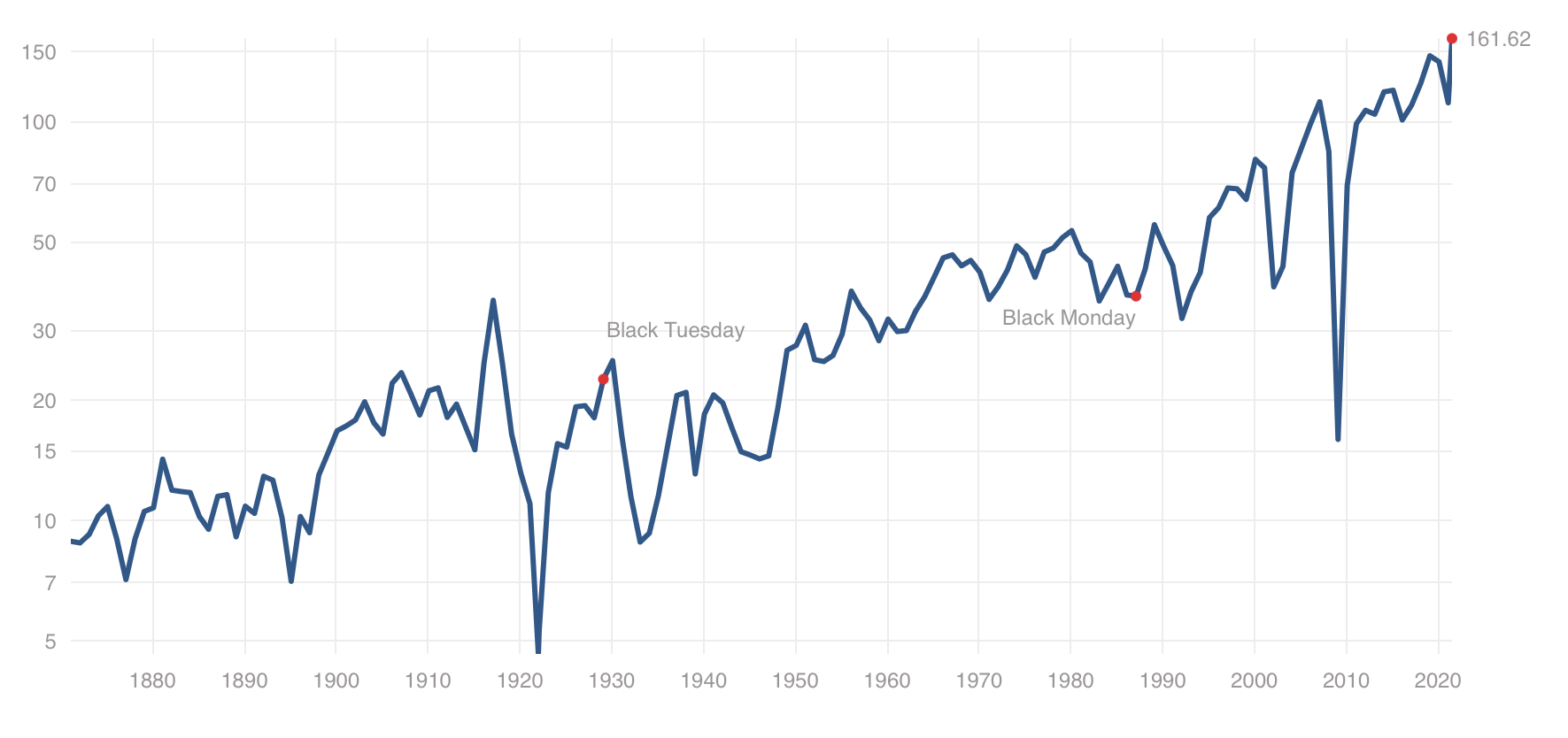

Shiller P/E hovering around 40 indicates value to risk ratio is extreme.

The market rise is based on an overextended debt plus an oversupply of money.

The oversupply of money is fueling inflation risk.

Global Market Status:

US Market:

The 12 month EPS for the S&P 500 equals 161.

Reported Jun 2021: https://www.multpl.com/s-p-500-earnings

Looking at the Global 200 day Moving Averages:

| Country | Ticker | Status |

|---|---|---|

| Australia | NQAU | Below the 200d |

| Indonesia | NQID | Above the 200d; Below the 50d |

| Japan | NQJP | Below the 200d |

| Korea | NGKR | Below the 200d |

| Hong Kong | NQHK | Below the 200d |

| China | NQCN | Below the 200d |

| Asia | NQASIA | Below the 200d |

| India | NQIN | Above the 200d; Below the 50d |

| Russia | NORUX50 | Above the 200d; Below the 50d |

| Russia | RSX | Around the 200d |

| South Africa | NQZA | Below the 200d |

| Netherlands | NQNL | Around/Below the 200d |

| Germany | NQDE | Below the 200d |

| Europe | NQEU | Below the 200d |

| United Kingdom | NQGB | Below the 200d |

| Latin America | NQLA | Below the 200d |

| Mexico | NQMX | Below the 200d |

US Markets:

| Country | Ticker | Status |

|---|---|---|

| Russel 2000 | Midday: IWM | Below the 200d |

| Nasdaq | Midday: QQQ | Below 30d; Above 50d |

| S&P 500 | Midday: SPY | At/Around 50d |

| Dow Industrials | Midday: DIA | Below the 200d |

Unite America with The Centrist Party

- The Centrist News invites you to consider joining the Centrist Party. We all need to work together to heal our nation and return balance in governance and common sense for our nation and the people.