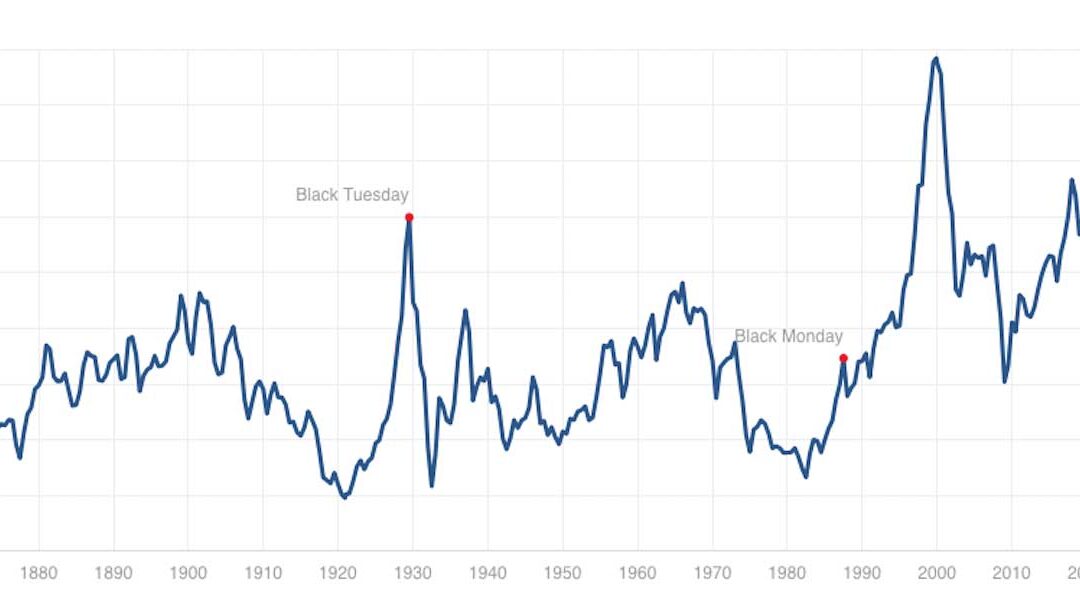

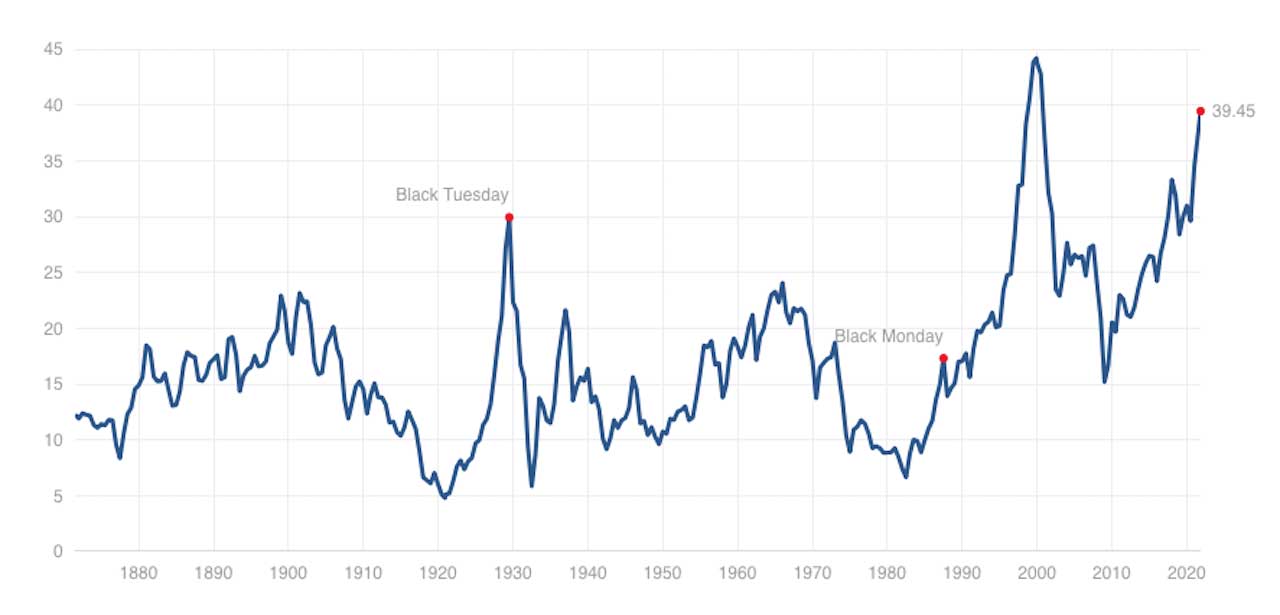

Shiller P/E ratio approaches 40

In this market report we explore the circumstances surrounding a rising market during a global pandemic, while inflation is rising in the core economy. And oddly, while people are feeling it, it is not widely reported in the metrics. Some of it is supply chain issues, but not all of it.

The Shiller at 40: It’s only been this high once before. That was the dot.com bubble. Think about this too: the Shiller has only been at 30 three times in modern market history. The crash of 1929. The dot.com bubble. And during the current global pandemic. Does something sound odd about this picture? Consider all that is going on and ask yourself: Isn’t this irrational exuberance?

With the Shiller ‘mean’ at 16.88 and the Shiller ratio nearing 40…during a global pandemic, while the fed has been flooding the market with liquidity, while debts continue to push into record territory, and profits rely on stability supported by unsustainable fiscal and monetary policy, AND while inflation is becoming increasingly apparent…

Artificial Inflation

It’s a simple equation. Short term free money = long term debt. Any increase in interest rates would wake up the markets, but as of today: still no sign of responsibility on the horizon. Free money also equals artificial inflation in market prices. The flood of liquidity has enabled markets to float on top of a bubble. But as we all know, bubbles do tend to pop. It’s just hard to recognize what form the needle will manifest as. And ‘when’ it will penetrate the bubble.

Rational market theory indicates the market is always at the right price for it’s current circumstance. But what if the market is no longer based on capitalism? What if the monetary and fiscal policies are not in line with short and long term realities of the market? History tells us that when this happens, markets eventually get a wake up call, or calls, and prices eventually deflate to move toward market reality.

In the mean time the fantasy persists.

Many market reporters are going with the flow, and there seems to be strong support for the idea that the markets are doing great.

Let us hold that thought and review why the markets are so high. Donald Trump pushed hard to lower taxes. That translates to ‘we have less ability to pay our bills’. Donald Trump pushed hard for zero percent interest rates even before the pandemic hit.

The Trump Plan

Trump knew that if he could get those rates down, it would support corporations. Said another way it would support the very ‘swamp’ he campaigned against. But let’s face it, Donald did that with a wink and a nod. Because he was also saying in ‘word and deed’ how much he supported the same corporations he spoke badly of.

The result was a sophist lie. People can continue to ignore facts at their own risk and to the peril of American and the global economy. But ignorance is only bliss for as long as the dragons of debt and inflation can be kept at bay.

Then the pandemic hit. Trump had what he wanted. An excuse/reason to drop the interest rates to zero. Realistically speaking, rates did not need to go to zero. It would have been enough to lower the rates to a point of market equilibrium. And if Trump had taken the pandemic seriously, we would have had a more functional economy and a safer public.

Trumps ‘Do Nothing Smart’ Campaign

Along with Donald’s ‘do nothing smart’ campaign and zero interest rates came a willing treasury department to start a new bond buying program. This infused the economy with liquidity. It stopped the markets from falling. In fact, there was so much liquidity, (free money in the system) that markets began to rise…IN THE MIDDLE OF A CRISIS!

It’s not magic though. It’s socialism on a grand scale. Important to note here that socialism means government owned and operated. The Trump administration not only designed and built this ‘no one be responsible economy’ it now owned and operated Trumps free money liberal economy.

“Casey Jones You Better Watch Your Speed”

Against all logic and reason. The markets were empowered to rise during a crisis rather then simply aim for stability. Then Joe Biden became president. Biden took a hands off approach. He left Trumps’ Fed appointee Jerome Powell in place to manage the Fed.

I’ll interject here. If it were me in the White House, I would have argued that prudence given a chance to speak for the first time in four years, might have said: ‘at least stop the market rise by reducing the ‘bond buy’ earlier; or maybe add a 1/4 point of interest to let the market know the higher it rises on debt, the harder it will fall as that debt comes due’. In other words, these Shiller levels are high-risk, and it is the governments job to reduce risk when feasible.

To be blunt, supporting a market rise during a global disruption is not responsible governance. Biden may be having trouble in steering us toward a safe landing at the moment, but let’s face it, decades of bad policy and Trumps steroidal influx of stupidity put us at this risk level.

And if by chance some new unforeseen, unexpected, or even an expected calamity occurs, this market could and would fall harder and faster.

To sum this up, with the Shiller P/E ratio above 39…, …it is getting harder and harder to NOT call these market levels irrational exuberance.

Unite America with The Centrist Party

- The Centrist News invites you to consider joining the Centrist Party. We all need to work together to heal our nation and return balance in governance and common sense for our nation and the people.